A Homebuyer’s Tale: A Real-Life Heroic Saga of Financial Triumph

Unveiling the Strategies That Catapulted One Couple to Financial Victory Amongst the Challenges of Today’s Real Estate Market

I don’t know if it’s for you or not, but in today’s challenging real estate climate high home prices and high interest rates have created challenging market conditions for many.

The following story, set in real-time amongst those very market conditions, however, illustrates how one couple we recently worked with used a financial real estate strategy to overcome substantial consumer debt, bought a much nicer home that fit their family’s needs, and still ended up hundreds of dollars ahead each month in their overall monthly expenses (see also our most recent video Buyers Saving Hundreds per Month from Recent Rate Reductions). This financial restructuring is known as blended rate, and if you’re anything like these folks, it could be a solution for you.

Allow me to set the stage: in the current economic landscape, consumer debt has reached historic levels, especially with soaring credit card interest rates driven by the Federal Reserve’s actions.

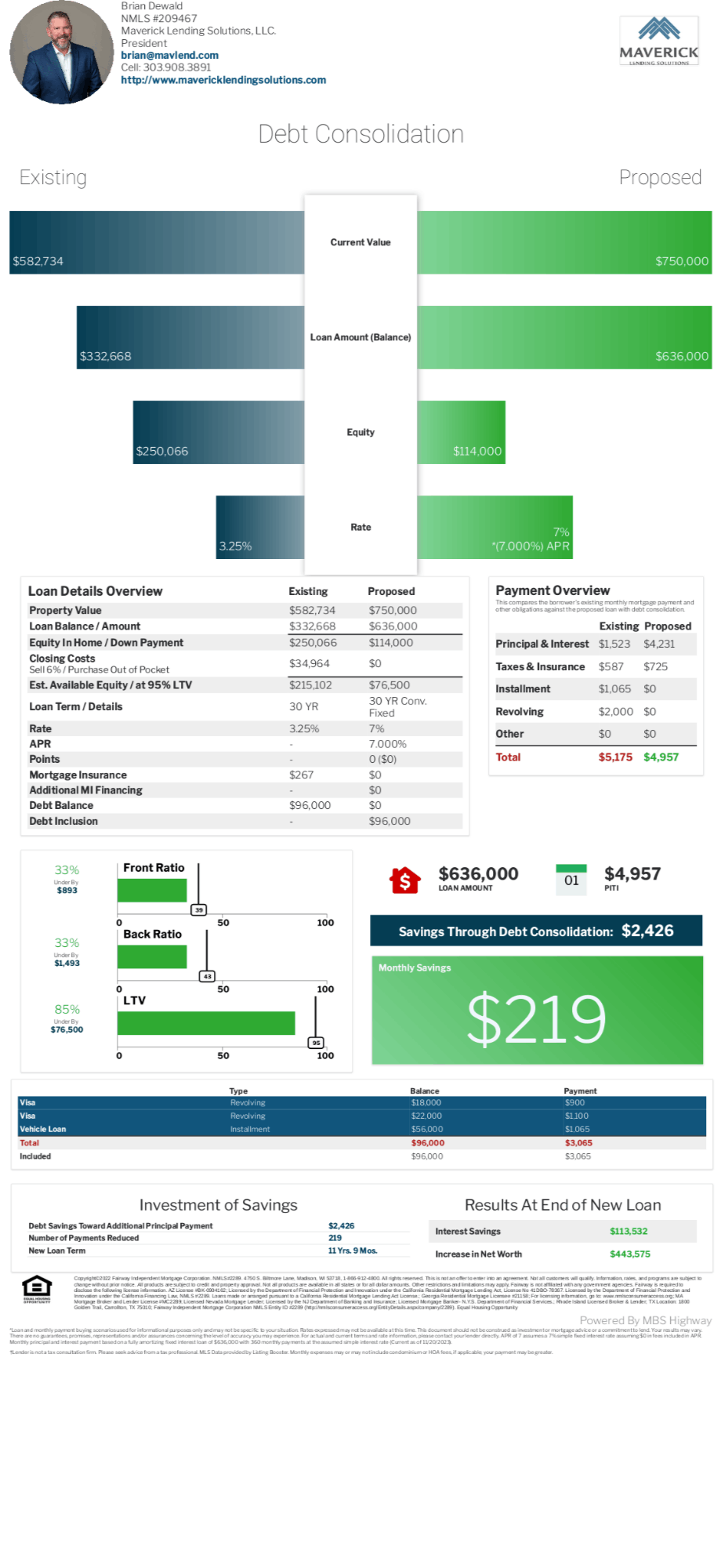

Our protagonists in the story, a real-life Colorado couple who purchased their home in 2019 for $430,000, had seen its value climb to an impressive $582,000 in four years. Despite a wise decision to refinance at 3.25% in 2021, they found themselves grappling with substantial credit card debt, and an exorbitant car payment—a common predicament for many households (see example below).

Let’s take a quick look at the villian of the story (besides The Fed): the nearly $100,000 in consumer debts they were juggling. This includes $40,000 in credit card debt and a $56,000 vehicle loan, amounting to over $3,000 in minimum monthly payments. Their dilemma necessitated a proactive solution: sell their current home before the pent-up homebuying demand surges, aiming to secure a better overall home and financial foundation.

Utilizing the equity from their increased home value, the couple paid off their high-interest credit cards. By consolidating their debts into the new $750,00 home loan, even at a higher interest rate of 7%, they achieved an overall monthly savings of $219–remember they had recently refinanced to 3.25%.

Delving deeper into the financial story, the couple utilized a blended rate approach to mitigate the bad interest associated with credit cards and an auto loan. This specifically resulted in a monthly reduction of expenses by $2,426, translating into an almost 20-year acceleration in paying off the loans! The cherry on top? A remarkable $113,000 in interest savings over the life of the loans and an increase in net worth to over $443,000!

This strategic financial maneuver not only provided immediate relief by lowering monthly payments but also sets the stage for their long-term financial stability.

The case study serves as a testament to the importance of evaluating and adjusting financial strategies in response to evolving economic conditions, empowering individuals to take control of their financial future.

In this very real scenario, it was our trusted financial adviser, senior lending officer, and hero of the story, Brian Dewald, that helped these folks using a blended rate approach to a much-improved financial standing.

Navigating consumer debt requires a creative and tailored approach, and we’re here to help you make informed decisions on your path to financial freedom through real estate.

We want you to be able to write a beautiful story of your own. So, if you find yourself in a similar situation or want to explore your financial options through a mortgage …reach out! This is precisely why we’re here.

To reach Brian Dewald:

Maverick Lending

President | Senior Loan Officer

303.908.3891

720.500.1880

www.mavericklendingsolutions.com

Categories

- All Blogs (61)

- advice (18)

- broomfield colorado (1)

- buying land (1)

- client experience (8)

- colorado (11)

- commerce city colorado (2)

- denver metro area (12)

- ELEVATE newsletter (14)

- FAQs (1)

- firestone colorado (1)

- first-time homebuyers (8)

- foothills properties (1)

- for buyers (1)

- for sellers (9)

- home improvements (1)

- home valuation (1)

- homebuyers (21)

- homebuying in 2024 (11)

- inflation (4)

- interior design & decor (1)

- investing/investors (3)

- land surveys (2)

- local news (11)

- market updates (2)

- matt thomas (3)

- monthly housing updates (7)

- mortgage interest rates (13)

- mortgage lending (8)

- mountain properties (1)

- moving (2)

- national news (9)

- negotiations (2)

- open houses (1)

- opinion (2)

- press release (3)

- property management (2)

- property taxes (2)

- radon (1)

- ReaL Broker (2)

- relocating (4)

- remote homebuying (1)

- rentals (1)

- renting (1)

- senior homeowners (2)

- showings (3)

- the altitude group (4)

- thornton colorado (3)

- videos (4)

- vocabulary (4)

Recent Posts

GET MORE INFORMATION

Consultant | Broker Associate | FA100030130