-

Are you considering buying a home this year? With a solid game plan and approach to buying a home, you can plan to win in 2024. Of course you’ll need to prepare. And hey, you’re off to a great start by reading this blog—we don’t want you to fall short of your goals either. But, like with just about

Read More Enigmatic Real Estate Market: Rising Rates, Multiple Offers, and Increasing Inventory...All at Once!

In this video, Matt Thomas & Brian Dewald discuss how rising mortgage rates, multiple offers and increasing inventory are impacting the real estate market. They also talk about the success of Brian's cash program for buyers and the potential easing off of selling mortgage bonds by the Federal Rese

Read MoreDenver & Front Range Housing Update: Insights into Market Balance and Pricing Trends

With a full first quarter behind us, we’re seeing improvements over last year, one of the slowest moving real estate markets in years. And, as always, we'll take a look at where the market’s been, where it’s at, and where it appears to be headed for the rest of 2024. Where We’re At | Local Housing M

Read MoreFind Out How You Can Access An Unbeatable All-Cash Homebuying Program

It's springtime and that means competition for homebuyers in the real estate market has picked up. If you're not cash rich, you may find yourself unable to compete for the house you want. Brian Dewald of Maverick Lending Solutions has a product that can help homebuyers in today's market in one of

Read MoreSaved by a Snow Squall and How the Market Melted it All Away

Where were you Tuesday morning? Wasn't that snow squall something? We woke up with no snow on the ground and no flurries in the air. By 10:00 AM most of the Metro Area was enveloped in a fast-moving snow squall that made it look like a February Christmas in less than 2 hours. The snow stuck to the s

Read MoreWhy Waiting to Buy a Home Might Not Be the Best Move - The Numbers Don't Lie

Mortgage rates inched up this week, prompting a pause among some prospective homebuyers. However, there are compelling reasons why waiting might not be the most advantageous strategy. Let's delve into the data and trends shaping the housing market landscape. Impact of Mortgage Rate Changes Home shop

Read MoreMastering the Art of Winning Home Offers: A Customized Approach with The Altitude Group

Navigating the journey to homeownership can be both exciting and challenging. But if there's one thing our experience fighting for the best interest of our clients has taught us, it's that no two home-buying scenarios are alike, and that's why we believe in a tailored, thoughtful approach to help yo

Read More-

As you embark on the journey of purchasing your dream home, it's crucial to delve into the details of the inspection phase, and one aspect that often deserves heightened attention is radon testing. Radon, a naturally-occurring radioactive gas, possesses the potential to impact your health, specifica

Read More Unprecedented 2-Day Plunge in Interest Rates Sparks Optimism for 2024s Housing Market

Seizing the Opportunity: Why Now Might Be the Perfect Time for Your Real Estate Move __________ Something big occurred just yesterday in the housing world--one of the biggest 2-day drops in interest rates we've seen in decades! On Wednesday, the Federal Reserve met and Chairman Jerome Powell spoke a

Read MoreA Homebuyer’s Tale: A Real-Life Heroic Saga of Financial Triumph

Unveiling the Strategies That Catapulted One Couple to Financial Victory Amongst the Challenges of Today’s Real Estate Market I don’t know if it’s for you or not, but in today’s challenging real estate climate high home prices and high interest rates have created challenging market conditions for ma

Read MoreDenver Metro Area Housing Update - November 2023

The latest housing news for November 2023. In our professional opinion, here's what you need to know about today's real estate market conditions--despite what you may have heard: Mortgage Rates and Market Trends In a surprising turn of events, traders are not currently pricing in another rate hike f

Read MoreDenver Metro Area Housing Update - October 2023

The latest housing news for October 2023. In our professional opinion, here's what you need to know about today's real estate market conditions--despite what you may have heard: Mortgage Rates at 8% Mortgage rates have reached 8%, a level not seen in 23 years. While this might be concerning, it's im

Read MoreBouncing Back After a Homebuying Setback: A Letter of Encouragement

Dear Homebuyer, I hope this message finds you in good spirits, despite the recent disappointment you've faced in your homebuying journey. First and foremost, I want you to know that I understand how disheartening it can be to have an offer fall through. It's a challenging part of the homebuying game

Read MoreDemystifying the 2/1 Mortgage Rate Buydown: A Simple Explanation

A 2/1 buydown is a type of financing that lowers the interest rate on a mortgage for the first two years before it rises to the regular, permanent rate. The rate is typically two percentage points lower during the first year and one percentage point lower in the second year. Since the summer of 2022

Read MoreElevate Your Home Search: Tips and Etiquette at a Showing Appointment

Since its premier in 1999, HGTV's House Hunters has racked up some 232 seasons. Hopefully I don't have to tell you that like all reality TV, much of the series is fantasy concocted for entertainment. But has the damage been done? It seems there's no one who hasn't seen at least several of the 230+ e

Read MoreOur Top 10 Tips for First-Time Homebuyers

As a seasoned real estate agent, I would love to offer 10 of my top tips for you, as first-time homebuyers. The only problem is there are far more than 10! This list should get you started–take a look. Determine Your Budget: Before you start looking for homes, establish a clear understanding of how

Read MoreHousing Reacts to The Federal Reserve's Pause in Interest Rate Hikes

If you're watching the market too closely, you may be doing a little fence sitting. There's nothing wrong with that. Stay informed, then jump when it's time to jump. With the Fed recently pausing interest rate hikes--it's been 15 long months--this might be that opportunity to jump. So will you? The

Read MorePrepping for Success: 8 Tips for Mastering Virtual/Remote Showings as a Savvy Homebuyer

In today's real estate market, virtual/remote showings have emerged as a convenient and efficient way for homebuyers to explore properties. With the assistance of a real estate agent, you can now view homes from the comfort of your own space. To ensure a successful virtual/remote showing experience,

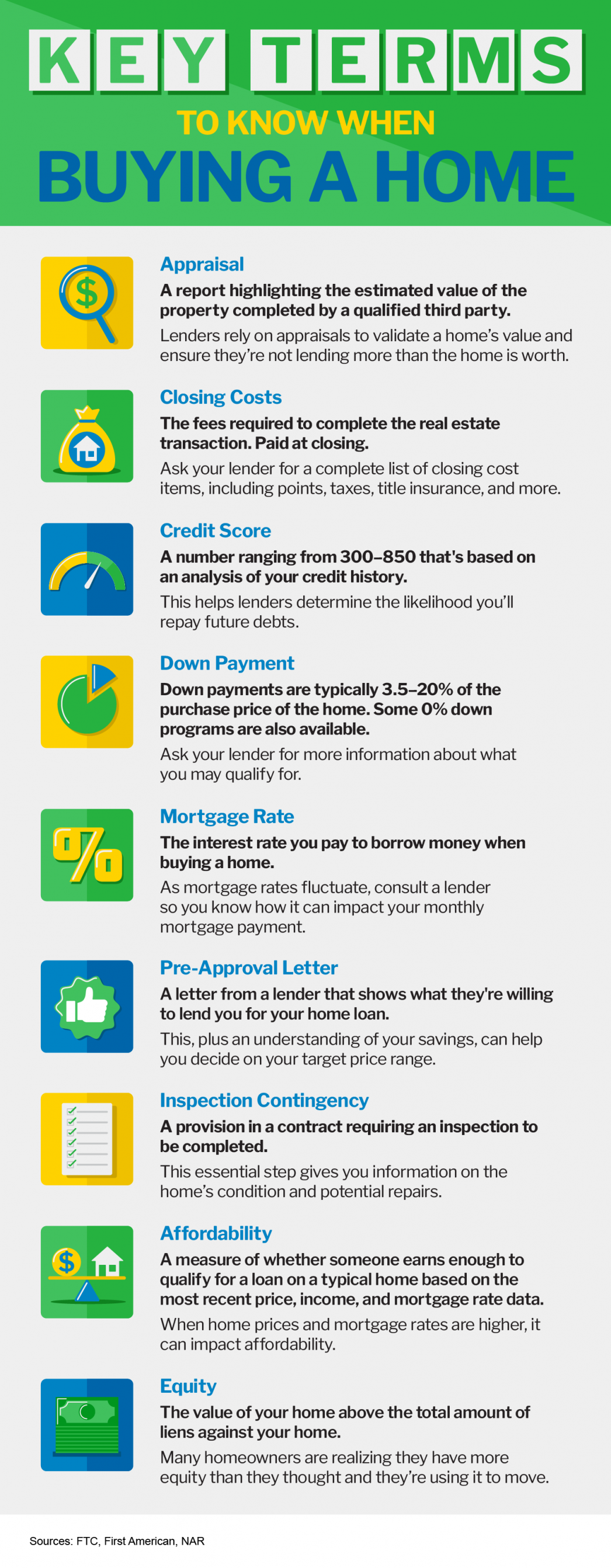

Read MoreKey Terms to Know When Buying a House

Some Highlights Buying a home is a major transaction that can seem even more complex when you don’t understand the terms used throughout the process. If you’re looking to become a homeowner this year, it’s important to know these housing terms and how they relate to the current market so you feel

Read More-

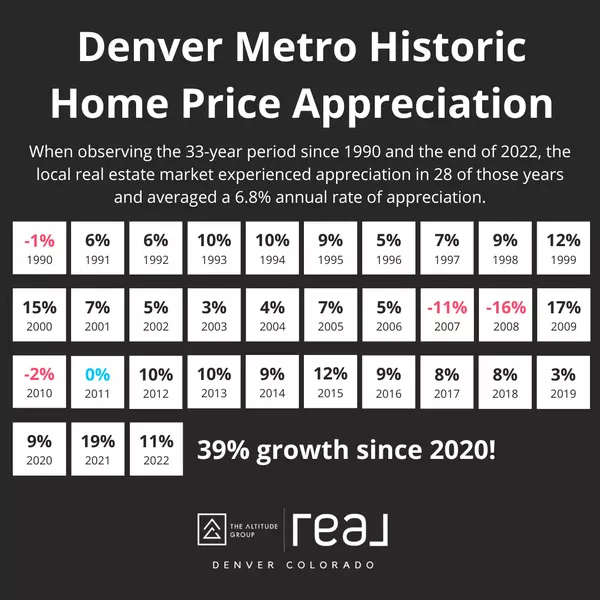

If I told you about an investment that, over the past 50 years, has averaged nearly 7% (6.8%) gains year over year, you would say what? Yet, so many people I talk with right now are feeling confused about where the real estate market is headed in 2023 given the grim news they heard over the last hal

Read More

Categories

- All Blogs 60

- advice 18

- broomfield colorado 1

- buying land 1

- client experience 8

- colorado 11

- commerce city colorado 2

- denver metro area 12

- ELEVATE newsletter 14

- FAQs 1

- firestone colorado 1

- first-time homebuyers 8

- foothills properties 1

- for sellers 8

- home improvements 1

- home valuation 1

- homebuyers 21

- homebuying in 2024 11

- inflation 4

- interior design & decor 1

- investing/investors 3

- land surveys 2

- local news 11

- market updates 1

- matt thomas 3

- monthly housing updates 7

- mortgage interest rates 12

- mortgage lending 8

- mountain properties 1

- moving 2

- national news 9

- negotiations 2

- open houses 1

- opinion 2

- press release 3

- property management 2

- property taxes 2

- radon 1

- ReaL Broker 2

- relocating 4

- remote homebuying 1

- rentals 1

- renting 1

- senior homeowners 2

- showings 3

- the altitude group 4

- thornton colorado 3

- videos 4

- vocabulary 4

Recent Posts