ELEVATE Newsletter: March 16, 2023

In this issue...

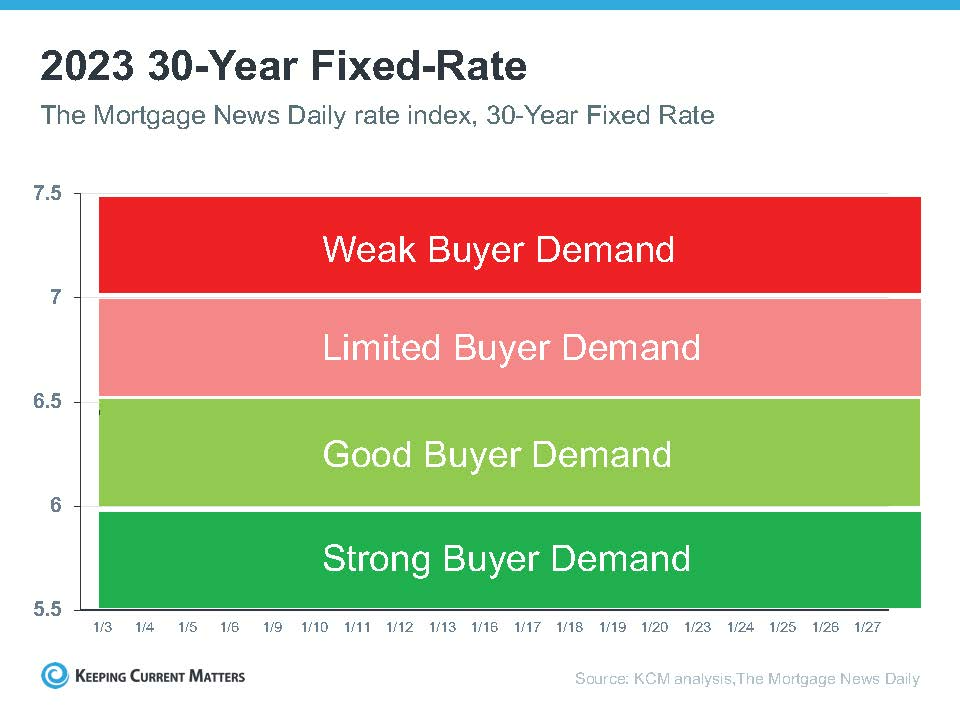

March 16, 2023: Over the first few months of the quarter the mortgage market has been about as volatile as anyone can remember. Beginning late last year, after Thanksgiving, rates slid (improved) for about 6 straight weeks. Since that time, we've seen rates spike again by about a point, then relax yet again for much of the last month before they began trending back the other direction yet again over the past week or two. That's enough fluctuation to make your head spin. Purchase applications tend to shadow the rates, whichever direction they go. This is nothing new. Rates always fluctuate. If you I quoted you a rate right now, it would be inaccurate by the time you called your favorite lender to lock in your rate.

Interestingly, housing inventory is also sensitive to the fluctuation. Rising rates cause hesitation in the marketplace. Low inventory is good for homesellers and in some price ranges, multiple offers have returned in part becuase there simply aren't enough houses to meet buyer demand. As spring approaches, there have historically been predictable increases in the number of homes listed.

So how is that impacting the housing market? Homes are still selling--we're headed into spring, after all. But any potential homebuyer at or near the top of their budget is going to be very sensitive to rate fluctuation/volatility.

As the illustration above shows, for now, rates less than 6.5% cause the market to move, yet as rates increase and approach the 7% mark, demand begins to slow in a way that causes home sellers to stay on the market longer and become more impatient with the home sale process.

Something I'm Pondering

“Be the designer of your world and not merely the consumer of it.”

James Clear, Atomic Habits

Categories

- All Blogs (61)

- advice (18)

- broomfield colorado (1)

- buying land (1)

- client experience (8)

- colorado (11)

- commerce city colorado (2)

- denver metro area (12)

- ELEVATE newsletter (14)

- FAQs (1)

- firestone colorado (1)

- first-time homebuyers (8)

- foothills properties (1)

- for buyers (1)

- for sellers (9)

- home improvements (1)

- home valuation (1)

- homebuyers (21)

- homebuying in 2024 (11)

- inflation (4)

- interior design & decor (1)

- investing/investors (3)

- land surveys (2)

- local news (11)

- market updates (2)

- matt thomas (3)

- monthly housing updates (7)

- mortgage interest rates (13)

- mortgage lending (8)

- mountain properties (1)

- moving (2)

- national news (9)

- negotiations (2)

- open houses (1)

- opinion (2)

- press release (3)

- property management (2)

- property taxes (2)

- radon (1)

- ReaL Broker (2)

- relocating (4)

- remote homebuying (1)

- rentals (1)

- renting (1)

- senior homeowners (2)

- showings (3)

- the altitude group (4)

- thornton colorado (3)

- videos (4)

- vocabulary (4)

Recent Posts

Denver Ranks Low Nationally…So Why Is Demand Rising?

So much happened in October…and now it's over. What should we make of it?

Enigmatic Real Estate Market: Rising Rates, Multiple Offers, and Increasing Inventory...All at Once!

Denver & Front Range Housing Update: Insights into Market Balance and Pricing Trends

Find Out How You Can Access An Unbeatable All-Cash Homebuying Program

Saved by a Snow Squall and How the Market Melted it All Away

Why Waiting to Buy a Home Might Not Be the Best Move - The Numbers Don't Lie

It's Always Sunny in the Bahamas | Denver Housing Market Update - February 16, 2024

There Could be Many Reasons for You to Turn Your Home into a Rental

The Top Reasons Not to Make Your Primary Home into a Rental

GET MORE INFORMATION

Matt Thomas

Consultant | Broker Associate | FA100030130