-

Are you considering buying a home this year? With a solid game plan and approach to buying a home, you can plan to win in 2024. Of course you’ll need to prepare. And hey, you’re off to a great start by reading this blog—we don’t want you to fall short of your goals either. But, like with just about anything, being prepared will have you ahead of the competition—and, if rates fall significantly, there will surely be competition. A persistent shortage of homes for sale will still likely cause challenges for buyers into 2024, leaving sellers in a favorable position. However, with interest rates falling, of late, could it be the year that buyers finally have the advantage? If you're considering house hunting this spring, make sure to allocate enough time to find the right property and bring your best negotiation skills to the table. Until then, here’s a breakdown of what's happening in today’s market and how you can prepare. Home Prices Have Stabilized. Will They Begin to Climb? The real estate landscape is currently characterized by stable home prices. After a three-year-long surge, prices have mostly held steady this past year, with some regions experiencing slight decreases and others seeing modest increases. As of November 9th, the national median price for existing homes was $430,300, according to the National Association of Realtors (NAR). Looking ahead, NAR predicts a 0.9% increase in the median price for existing homes in 2024 compared to the previous year. Fannie Mae was among the most optimistic predicting a 2.4% increase, while realtor.com® predicts a 1.7% decrease in median home value in 2024. Here in Colorado, the median home value was significantly higher than the national average at over $612,000. That means you’ll really need to save for your down payment. The NAR recently reported a discrepancy in cash (down payment) availability between first-time and repeat buyers. First-time buyers typically make a median down payment of 8%, while repeat buyers put down a higher median of 19%. Interest Rates Remain Relatively High In 2024, it’s high time to acknowledge that historically low mortgage rates are a thing of the past, with rates rising to a 30-year peak in October 2023. However, beginning in November rates began a six-week decline, then stabilized at the end of the year. Currently, rates are holding well below 7% and some experts think we could see rates decrease into the high 5s at some point this year, perhaps as early as Q2. NAR predicts the 30-year fixed-rate mortgage to average 6.3% in 2024; realtor.com® projects 6.5%. This likely will improve housing affordability and entice more home buyers to return to the market, according to NAR’s Chief Economist Lawrence Yun. The Federal Reserve's efforts to curb inflation have contributed to this trend, with 3 interest rate decreases planned for 2024, if patterns hold (always a big if). While rates may impact initial mortgage costs, it's worth considering the option to refinance if rates decrease in the future. What Can You Afford? NAR’s data shows that rates near 6.6% enable the average American family to afford a median-priced home without devoting more than 30% of their income to housing, the threshold commonly used to measure affordability. We can recommend our trusted lender partners so you can quickly and accurately determine what’s truly affordable for your unique scenario. Competing for That Primo House According to October 2023 data from NAR, over 25% of homes are still selling above their listed price, with 28% of homes achieving this in that month. The median time homes spent on the market was 23 days, and on average, each property received 2.5 offers, indicating a persistently competitive market. NAR’s Yun emphasized the significant impact of limited housing inventory on satisfying housing demand, stating, "Multiple offers, of course, yield only one winner, with the rest left to continue their search." On the other hand, cash transactions continue to play a notable role in the marketplace, with nearly one in three sales (29%) completed in cash, up slightly from the 26% reported in 2022. So, if you have cash, you’re in a better position than most of the market. However, financing is only one aspect of competing for a home and there are many other ways to stand out. MORE >>> Offer Strategies that Win Flexibility and Compromise As a homebuyer, there are aspects of the real estate market you simply can’t control. For instance, you can't control inventory or when someone decides to put their house up for sale. What you do have control over is your own outlook and readiness. Consider that finding the absolute perfect home should remain your BHAG (big, hairy, audacious goal) but that a "good enough for now" home can kickstart your homeownership journey sooner and may keep you from having the market pass you by. This rings particularly true for first-time buyers eager to start building equity. It’s no secret that real estate presents opportunity as a very solid investment long term, and often in the short term. Putting off buying six months or a year might mean losing out on tens of thousands of dollars. That said, if you find yourself constrained by your options consider broadening the scope of your search to include smaller homes, additional areas, or even different types of housing options such as condos or townhouses, as a suitable compromise. Perhaps you can make do with fewer bedrooms or bathrooms or adapt to a slightly outdated interior. And, while I’m not your dad, my best fatherly advice is: keep your spirits up—even if it means tolerating less square footage or putting up with quirky linoleum floors for a bit, you'll end up with equity to remodel or sell down the line. How to Prepare: Tips for Winning in 2024 No matter which direction rates go, it’s always great to be prepared for opportunity. If you’re one who likes to prepare (and we highly recommend you do) here are some tips to prepare for and compete in the housing market in 2024 (adapted from a recent article from NerdWallet): Get your finances in order: Review your budget, down payment capabilities, and credit score. Consider consulting with a loan officer for guidance on improving your financial profile. Understand mortgage options: Explore various mortgage options beyond the misconception of needing a 20% down payment. FHA and VA mortgages, as well as down payment assistance programs, offer alternatives. Shop mortgage lenders: Compare offerings from different lenders, considering not only interest rates but also the annual percentage rate (APR) and overall loan costs. Hire a good real estate agent: Choose a buyer's agent with market expertise who can guide you through the process, provide referrals, and navigate current market conditions. Make your best offer and negotiate wisely: Beyond monetary considerations, be flexible with terms such as the closing date. Negotiate wisely and only make concessions that align with your financial capacity. Don't give up: Persistence can pay off in a competitive market. Stay optimistic, be prepared to act swiftly, and seize opportunities when they arise. Bottom Line Don’t get down about the sky-high costs and the scarcity of options, especially if you're a first-time buyer who's been holding off on the house hunt. With today’s market conditions you may experience challenges. Our advice? Consider the long game. Waiting around for lower rates might end up with you facing even higher prices and tougher competition. So, if your heart is set on buying, focus on finding a place that checks as many of your boxes as possible within your current budget, all the while remembering that buying real estate often means compromising. I always remind my homebuyer clients, “even the buyers at $2.3M may have to compromise on that infinity edge pool if they can only afford to get an in-ground pool when everything else is perfect.” Setting your sights on perfection can often lead to unnecessary disappointment. Homebuyers often expect that they’ll hit a home run with their very first first at-bat when making a purchase. Sometimes, I gently remind them that nothing conquers inflation like real estate, so being in the game is important, even if you start by just getting on base. In any case, staying informed and adapting your approach will be key to success in this ever-evolving real estate landscape… …and we’re here to help. You just have to ask.

Read More Why Waiting to Buy a Home Might Not Be the Best Move - The Numbers Don't Lie

Mortgage rates inched up this week, prompting a pause among some prospective homebuyers. However, there are compelling reasons why waiting might not be the most advantageous strategy. Let's delve into the data and trends shaping the housing market landscape. Impact of Mortgage Rate Changes Home shoppers are keenly attuned to fluctuations in mortgage rates, as evidenced by the recent uptick in the average for the 30-year fixed-rate mortgage, reaching 6.77%. This increase led to a 3% decline in mortgage applications for home purchases, according to the Mortgage Bankers Association. While even marginal changes in rates can influence purchasing power, borrowing costs have generally stabilized. Jessica Lautz, Deputy Chief Economist at the National Association of REALTORS®, notes that despite the weekly uptick, mortgage rates have followed a downward trajectory since fall 2023, now sitting a full percentage point below recent highs. Considerations for Prospective Buyers Waiting for mortgage rates to decrease may not yield significant savings. Even a slight decrease in rates may not substantially alter monthly mortgage payments, particularly as home prices continue to rise. With the median price of existing homes reaching all-time highs and projected to climb further, buyers face the challenge of navigating a market characterized by low inventory and persistent price pressure. Regional Trends and Market Dynamics While national averages provide insights into broader trends, it's essential to examine regional nuances. In the Denver and Front Range area, for example, housing market dynamics may differ from the national landscape. The region has witnessed an increase in new listings, signaling growing interest from sellers. Additionally, inventory levels have seen a slight uptick compared to the previous year, potentially offering buyers more options. However, this increased inventory is accompanied by rising mortgage rates, which could impact buyer demand and price dynamics. Implications for Sellers and Price Dynamics As sellers ease back into the market, the region has seen a steady growth in active inventory, albeit at a fractionally slower pace than in previous weeks. While this may provide buyers with more choices, it also raises questions about the balance between supply and demand. Furthermore, the sensitivity of homebuyers to higher mortgage rates is reflected in the increasing number of price reductions, indicating a cautious approach among consumers. Future Outlook and Considerations As the housing market continues to evolve rapidly, monitoring key indicators such as inventory levels, sales growth, and price reductions is crucial for gauging future trends. While median home prices have remained relatively stable in recent weeks, the impact of sustained high mortgage rates on price dynamics remains uncertain. Whether home price gains will persist in the face of elevated mortgage rates is a question that warrants close observation in the coming months. Bottom Line In navigating the current housing market, prospective buyers in the Denver and Front Range area, like their counterparts nationwide, must carefully evaluate their options. While waiting for lower mortgage rates may seem tempting, the broader market context, including rising home prices and shifting inventory levels, suggests that delaying purchases may not necessarily result in significant savings. By staying informed and adaptable, buyers can make informed decisions aligned with their long-term goals in a dynamic real estate landscape.

Read MoreThere Could be Many Reasons for You to Turn Your Home into a Rental

For many, it can make sense to keep your primary home as a rental property, especially if you’re looking to bolster your real estate investment portfolio. And for anyone who took advantage of historically low interest rates just a few years ago, they are faced with the dilemma of selling and getting rid of that epically low rate forever. Yet many are, especially when it just isn’t financially feasible to hang onto multiple properties or buy the next one without cashing in. For those who want to keep their property that cash-flows and has a wonderfully low rate, or is paid off, there are benefits. Here are ones we came up with for you to consider. Additional Income: Renting out your home provides a source of passive income, helping offset mortgage payments, property taxes, and other expenses. Diversified Investment Portfolio: Owning rental property diversifies your investment portfolio, potentially providing long-term financial stability and growth. Tax Benefits: Landlords may be eligible for various tax deductions, including mortgage interest, property taxes, depreciation, and maintenance expenses. Asset Appreciation: Real estate values may appreciate over time, allowing you to build equity and potentially generate a profit when you eventually sell the property. Flexibility: Renting out your home offers flexibility in case you need to move for work, travel, or other reasons, providing a backup plan for housing. Market Demand: If there's strong demand for rental properties in your area, you may be able to secure reliable tenants quickly and achieve competitive rental rates. Long-Term Investment: Real estate is often considered a stable, long-term investment, providing a hedge against inflation and market fluctuations. Property Utilization: If you're not currently occupying the property, renting it out allows you to make use of the space and generate income rather than leaving it vacant. Potential for Cash Flow: Depending on rental income versus expenses, your rental property could generate positive cash flow, providing financial stability and additional funds for other investments or expenses. Future Options: Renting out your home provides the option to move back in or sell it at a later date, maintaining flexibility. This can be an especially nice option if your move may be temporary and is helpful to combat market uncertainty and fluctuation. If you’re considering hanging onto your primary home as a rental and the reasons above are speaking to you, it may just make sense in your case to do that.

Read MoreThe Top Reasons Not to Make Your Primary Home into a Rental

As a REALTOR, I meet with a lot of people who are faced with the question of whether or not to sell their home in order to buy the next one in the event they can afford to do so. That question has become even harder to answer now that so many homeowners took advantage of the historically low interest rates in the post-pandemic world of the early 2020s. Of course the answer to this question is going to be personal to you and your situation. Let me suggest several reasons why it may NOT be a good idea to keep your primary home as a rental. Shopping for a Rental vs. Your Dream Home: The first reason that gets overlooked as much as any is the fact that when you shop for a rental you shop based on drastically different criteria than when you’re looking for your ideal dream home, if you will. You will have different aspects of a property that stand out and matter to you when you’re looking for a home you want to live in compared to when you shop for one to put renters in. That leads me to my next point… Personal Attachment: You may have emotional ties to your home, making it difficult to deal with potential tenant issues or changes to the property. Uncertain Rental Market: If the rental market in your area is weak or unstable, you may struggle to find reliable tenants or achieve desired rental income. Maintenance Costs: As a landlord, you're responsible for maintaining the property, which can incur significant costs over time, especially if the home is older or requires frequent repairs. And renters never care for your property the way you would…ever. Legal and Financial Risks: Landlords are exposed to various legal and financial risks, including liability for tenant injuries, property damage, and potential lawsuits. If you’re not familiar with your liabilities as a landlord, you’re going to want to bone up on them. Loss of Flexibility: Converting your primary home into a rental limits your ability to sell or make changes to the property without disrupting tenants or terminating lease agreements. Mortgage Considerations: Some mortgage lenders have restrictions or may require approval for converting a primary residence into a rental property, potentially complicating the process. Property Depreciation: Renting out your home could result in wear and tear that depreciates its value faster than if it were owner-occupied. Tenant Management: Dealing with tenant turnover, late payments, or disputes can be stressful and time-consuming, especially if you don't have experience as a landlord. Local Regulations: Landlord-tenant laws, zoning regulations, and homeowner association rules may impose restrictions or additional requirements on renting out your property. Potential Loss of Tax Benefits: Converting your primary home into a rental property may impact your eligibility for certain tax deductions or exemptions associated with homeownership. If you’re ready to take on these obstacles and it just makes financial sense for you, by all means, rent away. Our next blog focuses on several reasons why turning your primary home into a rental could be right for you.

Read MoreMastering the Art of Winning Home Offers: A Customized Approach with The Altitude Group

Navigating the journey to homeownership can be both exciting and challenging. But if there's one thing our experience fighting for the best interest of our clients has taught us, it's that no two home-buying scenarios are alike, and that's why we believe in a tailored, thoughtful approach to help you secure the home of your dreams. Unlocking the Secrets to Winning Offers So when we're asked the burning questions of every homebuyer - "How do we win this house?" or "What's the lowest offer we can make?" - there is no one-size-fits-all answer. Each situation is unique, and what worked in a previous negotiation might not apply to your current endeavor. Nevertheless, there's a wealth of wisdom to be gained from every attempt, be it a victory or a learning experience. At The Altitude Group, we pride ourselves on providing winning advice by taking a customized, thoughtful approach based on the unique factors influencing your offer. Here's a glimpse into our winning offer strategy: Price, Terms, and Your Goals: We analyze the interplay between price, terms, and your personal goals. A careful consideration of these elements allows us to craft an offer that aligns with your objectives while remaining competitive, while keeping in mind any information we’ve gathered about what the seller is looking for. Understanding Market Conditions: Knowledge is power. We keep you informed about the current market conditions, helping you understand whether it's a buyer's or seller's market. This insight guides our strategy for a more informed and competitive offer. The Power of Pre-Approval: A strong pre-approval not only streamlines the process but also enhances the attractiveness of your offer. We guide you through the importance of this step to strengthen your position and we’ll seek to involve the lender as part of our team approach to show strength and viability. Personalization is Key: Tailoring your offer to the seller's preferences can make a significant difference. We explore ways to personalize terms, such as flexible closing dates or accommodating special requests. Understanding Seller Motivations: Knowing why a seller is parting with their property can be a game-changer. We help you decode seller motivations to refine your negotiation strategy. Professional Connections Matter: Our established relationships with industry professionals, from mortgage brokers to inspectors, contribute to a seamless process. Trust in our network to navigate the complexities of real estate transactions. Taking the Next Steps In a competitive market, timing is crucial. We urge you to respond promptly to new listings, armed with the knowledge and confidence to act swiftly when the right property comes along. Remember, flexibility in negotiations and transparent communication are key components of success. As you embark on this exciting journey with The Altitude Group, rest assured that our team is committed to guiding you through each step. Whether you're facing a multiple-offer scenario or dealing with a property that has lingered on the market, our approach is tailored to your unique situation. This is why we have a long list of satisfied clients. It’s our mission and duty to help you make your next home purchase a reality.

Read More-

As you embark on the journey of purchasing your dream home, it's crucial to delve into the details of the inspection phase, and one aspect that often deserves heightened attention is radon testing. Radon, a naturally-occurring radioactive gas, possesses the potential to impact your health, specifically increasing the risk of lung cancer. In this blog post, we'll explore the significance of radon testing, the associated risks, and the proactive steps you can take to ensure a safe and healthy living environment. To begin, it's essential to understand the nature of radon—it's colorless, odorless, and inert. These characteristics make radon testing a vital component of the inspection process, allowing you to uncover potential risks that may otherwise go unnoticed. For a comprehensive guide on radon, we recommend exploring the EPA's resource, which provides valuable insights into the testing process and mitigation strategies: EPA Radon Guide. In Colorado, the entire Front Range falls into the EPA's Zone 1 designation, indicating predicted average indoor radon screening levels greater than 4 pCi/L. Both the CDC and EPA recommend mitigation at a conservative level of 4.0 pCi/L, emphasizing the importance of addressing this concern during the homebuying process. Understanding that radon levels in the soil vary based on soil chemistry, it becomes apparent that the escape of radon into the house depends on multiple factors, including weather conditions and soil porosity. Particularly, the basement is susceptible to radon accumulation, making it a focal point for testing and mitigation efforts. Builders are increasingly recognizing the importance of radon mitigation, with some incorporating passive radon mitigation systems as a standard practice. Despite varying opinions on radon's significance in real estate transactions, it's evident that awareness and action are on the rise. Radon testing is a straightforward process, typically taking a couple of days. Most home inspectors can facilitate the testing, leaving the kit in the home for at least 48 hours. The results empower you to make informed decisions, such as requesting the seller to install a mitigation system or provide a credit for one. At the time this blog post was published the associated cost of radon testing generally ranges from $125 to $150. Beyond meeting regulatory requirements, testing for radon offers a specific understanding of your home's potential hazards. This knowledge provides peace of mind, especially when radon levels test low. Whether you're planning to occupy the basement regularly, the basement is already finished, or you have future finishing plans, radon testing is a proactive step toward ensuring the safety and well-being of your household. Bottom Line Because Colorado ranks among the top ten states in terms of radon prevalence in the US, it's clear that addressing radon during the homebuying process is not just a regulatory requirement but a crucial step in securing a healthy living space. Feel free to share your thoughts or reach out if you have any questions. Your proactive approach to radon testing contributes to the overall assurance of a safe and healthy home.

Read More -

When preparing your home for sale, few things can have as large and immediate impact as painting. If you're selling your house, painting is a great way to increase your resale price. Paint color takes up much of a room's visual space — it draws the eye and can even influence your mood while you're in the room. As a general rule, you want to stick to as few colors as possible, even if they are all neutrals. Using the same color in more than one area will give your home an overall cohesive feel. It also makes your home seem bigger, since there is an easy flow from one room to the next. THE IMPACT OF PAINT COLORS The choice of paint colors can significantly influence a buyer’s perception of your home. The right color palette can make your property feel inviting, spacious, and up-to-date. On the other hand, outdated or overly personal colors might deter potential buyers. Therefore, it’s crucial to consider current design trends and the psychology of color when selecting your paint hues. The most appealing color to paint the inside of a home when selling it is usually a neutral color, such as white, beige, or gray. These colors appeal to the majority of buyers and provide a blank canvas that allows them to easily visualize their own belongings and style in the space. Generally, going with neutral colors like shades of white, beige, taupe, and grays lead to a faster sale," she shares. "Neutral colors are also more appealing to potential buyers because many want the creative freedom of a blank canvas to add their personal touches to when looking for a new place to call home. From a seller's point of view, it can be risky having bright, bold paint colors because personal preference ranges greatly from person to person." 1. CLASSIC WHITE White is a timeless and enduring favorite among home sellers. It creates a clean and fresh canvas that allows potential buyers to envision their own style and décor in the space. However, not all whites are created equal; consider opting for a warm white with a hint of cream to add a touch of warmth and coziness to your rooms. Remember to consider your home’s architectural style and the preferences of your target buyers when selecting paint colors. By choosing wisely, you can enhance your home’s appeal and increase your chances of a successful sale in the competitive real estate market. 2. SOFT GRAY Gray continues to be a popular neutral color that appeals to a wide range of buyers. Opt for soft, warm grays that create a soothing and elegant atmosphere. Light gray walls can make rooms appear larger and more inviting, making it an excellent choice for various spaces throughout your home. 3. GREIGE Greige, a fusion of gray and beige, is a versatile and contemporary color choice. It offers a subtle warmth while maintaining a neutral backdrop for various decor styles. Greige works particularly well in living rooms and bedrooms, creating a sophisticated yet comfortable ambiance. Consider consulting with a professional painter when making color selections. You could have different tastes (that’s ok, by the way) but a painter knows what shades are not only popular, but how they vary from the paint swatches/chips to then they’re actually applied on the walls, what colors work well together (and which don’t), and how colors work in different types of light. We have a list of preferred vendors and contractors available to our private clients. WHAT’S TRENDING Consensus says that Sherwin Williams Agreeable Gray (SW 7029) is still the number one most widely-appealing choice to paint the interior of your home when preparing it for sale. Sherwin Williams Alabaster (SW7008) is second on many lists and offers a creamier white option for those who are tired of grays or where a gray isn’t the right complement to existing decor choices. Sherwin Williams Gray Mist is a compromise of the first two favorites, not gray, not beige, but a “greige” compromise. Another favorite is Sherwin Williams Snowbound (SW 7004) for a creamy white option. However it suits an exterior better where conveying warmth isn’t as critical as it is with interior paint colors. WHAT THE EXPERTS SAY Warm neutrals were a top choice for homeowners in 2023, and that trend I can see continuing. 82% of experts recommend warm-tinted neutral paint for selling because of the likelihood that it won’t turn away buyers for being too bright or too cold. Warm colors are welcoming, and neutrals don’t impose your personal style, so they’re great for inviting prospective buyers to see their future in your home. They can give texture to small rooms that may look sterile painted in white, and they can open up larger rooms that may feel smothered in rich, deep color. In contrast, spaces feel more open and unified when the same color is used across all rooms on a floor. Uniform paint choices can be more widely appealing and offer a clean-slate-feeling for potential buyers. This lets buyers more easily envision what customizations they want, thus making your home more attractive to them. The more they wrestle with your custom touches, the less they feel drawn to your home. BOTTOM LINE At the end of the day, it’s your house, so it’s your choice. Just remember, if you’re painting so you can appeal to the most buyers, put your trust in the experts. We’re always here to help. Please reach out to begin your staging and home prep consultation.

Read More -

As closing approaches you may find yourself moving before the sale is finalized with a buyer. To ensure a smooth handoff to the buyer whether you’re still in town or not, you'll need to make sure you have completed everything you are supposed to—from negotiated terms to good seller etiquette. There are certain things that every responsible seller should do, and you can make sure you accomplish them all if you make a home-selling checklist. Your closing checklist is a guide for your actions after all of your personal belongings and furniture have been removed from your home. This includes Clean the house Preparing the house to be vacant Be sure to close any relevant utility accounts Securing the property Change your address with the post office Customary Expectations Most Sellers are good about leaving a home in presentable condition for the new Buyer. It’s understandable that after moving all day, sellers may be too tired to spend a lot of time cleaning, so it's a good idea to move one day and clean the next, leaving an extra day before closing when possible. An alternative would be to hire a cleaning service to do a thorough deep cleaning. Clean the House If you don't have time to personally clean the home before leaving it, hire a professional cleaning service to do so. What makes a house clean enough is often a matter of opinion and personal preference. It's not always necessary to shampoo the carpets, but it's a nice touch. Clean the cabinets, refrigerators, and other appliances inside and out. Make sure the home is devoid of any trash and debris. Don’t leave personal property of any kind behind, except for what’s already been negotiated. Don’t forget the exterior: mow, rake, clear snow, clean up after pets, etc. We have a list below that will give you a good idea of what specifics matter. The Golden Rule The best way to ensure a worry-free final walkthrough is to follow the Golden Rule which is, of course: do unto others as you would have others do unto you. In other words, leave your home the way you would like to find it if you were the buyer. Don’t leave any room for interpretation of what is acceptable. And, it doesn't hurt to make your last impression on the buyer a good one with little touches (like polishing sink fixtures). The last thing you want is a threat from the buyer to not close based on the condition you left the property. If you leave it so there’s no room for complaint, then you likely won’t get complaints from the buyer. Cleaning List While many Buyers will clean the home to their own standards before moving in, regardless of a Sellers’ own cleaning efforts, there is a list of things a Seller can do to leave a home clean and create goodwill with the Buyer. This list is not comprehensive, but it will serve to get you started. Use your judgment for anything else that might need to be done. Remove all personal property. Throw away trash and debris. Vacuum the carpets & floors,sweep & mop tiled areas. Clean kitchen appliances, inside the refrigerator and oven, and wipe down counters. Scour sinks and tubs. Wipe down interior cabinets and shelves. Clean out the garage. Clean up after pets. As best you can, leave the yard in the condition it was in in your listing photos. Don’t forget your patio/lawn furniture, gas grill, etc. Stack items pertaining to the home such as paint cans, roofing materials or extra flooring and leave them for the new buyer, ONLY if they want them. If they don’t expressly want them, plan to have them removed. Leave the home in the condition you would hope to find it in if you were moving in. Preparing Your Home to be Vacant For some, peace of mind comes from leaving a house winterized so that you can neutralize the threat for potential water leaks, etc. If that’s you, you're going to want to turn off shut-off valves to sinks, toilets, dishwashers, the water heater, refrigerator and washing machine. Leave a note for the buyers so they won't call a plumber. Turn off all switches for lights and fans. Some sellers flip all of the circuit breakers to the “off” position. This might be overdoing it, but it keeps them from paying for any electricity until the account is switched. In most cases, we don’t recommend this approach. However, if the house has to be shown again or inspected, you’ll want the house to still be functional, and walking into a house that is literally cold, can leave a cold feeling with a new buyer. If they can’t turn on lights or test fans, then it’s tough for them to see how the house functions. Inspectors are not allowed to open valves and flip breakers, so we recommend leaving them on. One solution to make sure pipes don’t freeze is to leave the temperature set at 50° or even 55°. That way the house isn’t being heated to comfortable room temperature when no one is there, but the pipes won’t freeze either. It’s up to you. Having water running is important for any inspection but not necessary for showings. Having power to the home, in our opinion, is highly advisable, however. Utility Accounts Once the property sale has closed, you can cancel all the utilities. But, as mentioned above, you won’t want to turn off electricity or gas until the sale has been completed. In the meantime you can discontinue services such as cable, internet, newspaper, and other routine delivery services. It’s up to your discretion whether or not to discontinue security. Be sure you can find phone numbers for each of your utility and entertainment companies in advance. Keep in mind that not every utility is always paid monthly. You might have a refund coming, have to pay a balance, or be able to transfer the balance to your next home. Necessary Incidentals Leave all house keys, remotes, gate keys, pool keys, access fobs, and mailbox keys for the new owner. The buyers will probably change the locks, but that won't happen the instant they move in. Put them in a kitchen drawer or other location that is easily found and let us know where the buyers can find them. Assemble a packet of appliance manuals, receipts, and any warranties as well. You might have come across manuals for the HVAC, security system, sprinkler system, or appliances as you are packing. If you have receipts from contractors, warranties, put them into an envelope or box, and leave them in a cupboard as well, along with the manuals and codes for the security alarms, garage or door openers, etc. What to Leave Behind - Inclusions & Exclusions If you need a refresher about what constitutes an inclusion versus an exclusion, check our educational video on the matter here. Don’t forget to make sure all items that are in the contract DO convey with the house. You should also consult your real estate contract before removing some items from the home. These may include “fixtures” – anything not already glued, screwed, taped or nailed to the house, rather easily removed from the walls or ceiling – such as curtain rods, window treatments, light fixtures, light bulbs, etc. Your real estate buy/sell contract may state that fixtures are to convey with the house. Do you remember what you agreed to in the contract? If you aren’t sure – just ask. Check cabinets, drawers, and storage areas for any forgotten items. Run one more check, even if your spouse or friend says they've gone through every room with a fine-tooth comb, searching for anything you might have overlooked. As mentioned above, you should obviously leave anything you’ve agreed to leave (by contract) for the buyers. But don’t be tempted to leave things you think they’ll want. Only leave things you know they want or are expecting. Sellers with the best of intentions may think to leave things such as paint for touch-ups, even when they’re properly labeled, may find that the buyers don’t want them and feel like they’ve been burdened with removal of those items after closing. That’s not what you want. Construction materials such as matching carpet swatches and pieces of flooring may be left with the best intentions, but again, the buyer may not want them. Don’t leave them unless you’re sure they’re wanted. Items such as mowers and snow blowers, might have value to you, and thus, you feel it’s a nice gesture to leave them to the buyers, but if they don’t want them it becomes a disposal burden they didn’t sign up for and may cause waves at a final walkthrough. Lock Up on Your Way Out Close the blinds and lock the windows and doors. You'd be amazed at how many people forget to close up the house. It is especially important to lock up if the home is going to be vacant for a while. Consider leaving an inexpensive lamp behind on a timer. FAQs Q: When should I cancel utilities when selling a home? A: You can call in advance to set up a cancellation for your utilities, but be sure not to have your utilities turned off until after you officially close on the sale. You will need your utilities on throughout the selling process, and, as mentioned above, an early shutoff could cause problems. Q: Many Sellers ask me “So how clean is clean enough?” A: The bottom line is leave the home in the condition you’d want to find it in if you were the buyer, which is “move-in ready.” Does that phrase leave room for interpretation? Think of it this way, just be sure that you leave it in the condition that would give the buyers no room to grovel, or complain or even reject it at a final walkthrough prior to closing. Don’t Forget… Lastly, keep in mind that some of your mail and package deliveries might come to the Buyers after you leave, and you’ll want them to forward it on or allow you to pick it up. Besides the fact that you will create goodwill, it is the right thing to do. Once closing concludes, it may make sense to exchange contact information (buyers and sellers) in case deliveries come up after closing that need to be redirected.

Read More Bouncing Back After a Homebuying Setback: A Letter of Encouragement

Dear Homebuyer, I hope this message finds you in good spirits, despite the recent disappointment you've faced in your homebuying journey. First and foremost, I want you to know that I understand how disheartening it can be to have an offer fall through. It's a challenging part of the homebuying game that even seasoned buyers sometimes grapple with. But, I also want you to remember that each setback can be a set up for a comeback and one step closer to your dream home. I encourage you to take a moment to regroup, reflect, and reenergize for the next opportunity. In baseball, they say that a great hitter fails seven times out of ten, and yet they are still considered legends. Similarly, in the real estate world, setbacks and rejections are an inevitable part of the journey. It's how you bounce back from these moments that will define your success. Here are a few insights and strategies to help you keep swinging for the fences, so to speak, on the way to buying your next home: Embrace the Learning Opportunity: Every offer, whether accepted or rejected, is a valuable learning experience. Did you know that, on average, homebuyers write multiple offers before one gets accepted? In fact, recent data suggests that the typical homebuyer submits around 3 to 4 offers before securing a purchase agreement–just two years ago, that number was twice as high. Take a moment to review what worked and what didn't in your previous offers. Were there any contingencies that may have weakened your offer? Did you miss any red flags about the property or neighborhood? Use these insights to refine your approach for the next home. Stay Patient and Persistent: The perfect home is out there, and it's just a matter of time before you find it. It's essential to remain patient and persistent. Realize that the right opportunity may take a little longer to come your way, but when it does, it will be worth the wait. Reevaluate Your Budget: It's possible that the recent setback was a result of financial constraints. Take a fresh look at your budget and consider making adjustments if necessary. This might involve saving a bit more, exploring different financing options, or reevaluating your expectations in terms of location or property type. Lean on Your Support System–but not Too Much: Homebuying can be an emotional rollercoaster. Don't hesitate to lean on your support system, whether it's family, friends–just be careful. Too many cooks in the kitchen can spoil the broth, as they say. Only consult with your closest family and friends, or professionals like myself. We're here to provide guidance, encouragement, and expert advice to help you navigate this journey. Each situation is unique, so when your uncle, who you never talk to, decides to have an opinion on how to best negotiate, or how much to ask for from the homeseller. Too often we see homebuyers turn to their friends or family for advice, only to get confused by the plethora of opinions. Refine Your Home Search Criteria: As your homebuying journey evolves, so may your priorities. Consider refining your home search criteria to better align with your needs and desires. This can help you focus on properties that truly resonate with you. Explore Alternative Options: If you're feeling frustrated with the traditional homebuying process, it may be worth exploring alternative options like off-market listings, foreclosures, or even rent-to-own arrangements. Sometimes, thinking outside the box can lead you to hidden gems. Remember, setbacks are not roadblocks but rather detours on your path to homeownership. Each rejection brings you one step closer to the home that's meant for you. Keep your spirits high, your goals in sight, and your determination unwavering. I'm here to assist you every step of the way, and I have no doubt that with your resilience and commitment, you will soon find the perfect place to call home. Your dream home is still out there, waiting to welcome you with open arms. Please don't hesitate to reach out if you have any questions, need advice, or simply want to chat about your journey. Together, we'll get back in the game, and I have no doubt that your next swing will be a home run. Wishing you strength, optimism, and success in your continued homebuying adventure. Warm regards, Matt REAL Broker

Read MoreTo Hold or Not to Hold an Open House: The Arguments For and Against

As I was packing up from another successful open house the sellers came home, right on time. We began to chat and before we knew it, we had been chatting for about 20-30 minutes. Before I had a chance to take the open house signs down outside on the driveway, an interested potential homebuyer burst in the door–it was obvious he was there for the open house. The homeowners had been away during the open house and came home briefly to get ready for another appointment later that day. So when the fellow came in the door, ready to see the house, the homeowners found themselves with a stranger inside their home and in a bit of a pickle? We had just closed the blinds, turned off all the lights and they were making a quick lunch. They weren’t ready for more guests but they were still excited about having someone new see the home that they’re so proud of and still wanted to sell. This is how it goes with open houses. Homeowners wrestle with questions like: Do we bend over backwards to accommodate everybody who wants to see the house? What if we just get looky-loos? Do I really want my neighbor looking for design ideas in my home? But shouldn’t we try everything? There is a case to be made that an open house could be the exact marketing instrument that enables your home to be seen by more potential homebuyers and, more importantly, the right buyer. Yet, statistics show that it is highly unlikely (3-6% chance) that the open house will be the reason a potential buyer decides to buy your home over someone else's. Of course there are several factors that can impact the success of an open house, including location within a community, how well it’s advertised, how well it’s signed, how widely appealing is the house you’re selling, the weather, events & sentiment of the local community, and regional norms. Regional norms? For example, in many areas in California, open houses are more widely attended in general than they are generally in Colorado. Great weather days (and we have many) can keep people engaged in outdoor activities, rather than seeing homes. Yet a dedicated buyer in need will take the time to schedule a private showing if they need to see a particular property. Conversely, however, bad weather can keep people away as well. A cold, snowy Saturday in February isn’t likely to bring people who aren’t serious enough about their home search to set up private showings and get them off their couch, into the snow, out of the car, and over to your cozy house. So the question remains: should we have an open house or is it not worth it? Allow me to share a list of reasons why you might consider an open house as part of the marketing your agent does to get your home sold. I’ll also share with you reasons why maybe, just maybe, you might not want to open your house up to neighbors and unrepresented strangers without agents. Reasons to Have an Open House Increased Exposure: One of the most significant advantages of hosting an open house is the exposure it provides for your property. Open houses attract not only serious buyers but also curious neighbors and passersby who might not have seen your listing online. This increased foot traffic and buzz can potentially lead to more offers. Digital Exposure: Interestingly, it's usually those who respond to online digital marketing that are the most likely to be serious about your home, rather than those who just follow the signs set up in your neighborhood pointing them to a property they likely aren't planning to buy. Serious open house attendees are the people who have digital home search apps notifying them of open house times. In fact, it’s the digital marketing itself that can be more effective and bring more awareness to the home-buying public about the house listing than the actual open house itself. Mobile home-search apps have special notifications and often, separate pages dedicated to open houses. Listings with open houses advertised often land at the top of an online search. Having your home listed there may bring extra attention to it from those watching for fresh listings and new options. Building Buzz: Open houses can give you a chance to add an element of competition to your listing. When showings and open houses overlap, there can be multiple parties in the home at the same time and that can brew a sense of urgency in those who are concerned someone else might buy the home first. A little competition never hurt anyone right? And imagine what competition could do for the price of your home. Face-to-Face Interaction: Open houses allow your agent to interact with potential buyers directly. This personal touch can help build rapport, answer questions, and address concerns in real-time. Buyers often appreciate the opportunity to speak with the listing agent directly, and in turn, your agent can size up potential buyers and gain clues from conversations that can be valuable in a negotiation. Immediate Feedback: Hosting an open house can provide instant feedback. You can gauge visitor reactions and identify potential issues with your home's presentation. This valuable input can help you make quick adjustments to enhance your property's appeal. Time Efficiency: By designating a specific time for open houses, you can minimize the disruptions to your daily life caused by sporadic showings. This concentrated effort can help you maintain your privacy while still accommodating potential buyers. Reasons Not to Have an Open House Privacy Concerns: Some homeowners value their privacy above all else. If you're uncomfortable with the idea of strangers wandering through your home, an open house might not be the right choice for you. Sure, most homebuyers will be strangers to you, but ones accompanied by another agent who has prequalified them first makes for a more private scenario. Privacy is a valid concern, especially if you have personal items or valuable belongings you'd rather keep out of sight. Security Risks: While real estate agents take precautions to ensure the safety of your property during an open house, there is always a small risk of theft or damage. If you have private, valuable or irreplaceable items in your home, you may prefer to limit showings to serious, pre-qualified buyers or certainly make the effort to put them out of reach. Unqualified Visitors: Open houses can attract curious individuals who have no intention of buying but are merely interested in browsing homes for fun. This can lead to wasted time and frustration if you're trying to sell quickly or avoid unnecessary interruptions. Inconvenience: Preparing your home for an open house can be time-consuming and stressful. Cleaning, staging, and vacating the premises for several hours can be a significant inconvenience, especially if you have a busy schedule or family to accommodate. By contrast, when you prepare for a showing, you’re expecting a prequalified homebuyer who chose specifically to see your house, rather than someone who saw the signs or smelled the cookies. Limited Impact: In some markets, open houses are less effective at driving sales. This can vary from state to state, or neighborhood to neighborhood. If your area primarily relies on online listings and private showings, the effort and resources required for an open house may not be justified. Bottom Line In the end, the decision to host an open house or not should be based on your specific circumstances and priorities. The Altitude Group can provide valuable guidance tailored to your situation and market conditions. Remember that there's no one-size-fits-all answer, and what works for one seller may not work for another. So, weigh the pros and cons carefully to make the best choice for your home-selling journey.

Read MoreElevate Your Home Search: Tips and Etiquette at a Showing Appointment

Since its premier in 1999, HGTV's House Hunters has racked up some 232 seasons. Hopefully I don't have to tell you that like all reality TV, much of the series is fantasy concocted for entertainment. But has the damage been done? It seems there's no one who hasn't seen at least several of the 230+ episodes—and it's ruined them! House hunting in real life is nothing like they depict on TV, especially not on that show. But it still should be fun and stress-free. I think home shopping should be considered an American pastime. From window shopping for homes online to jumping in the car with a REALTOR, Americans love to dream about their dream homes. Still the question remains, has anyone taken the time to review with you the purpose and objective of a showing? Do you know how to handle yourself and your family at a showing? What buttons can I press or drawers can I open? And do you know what to bring to a showing or what NOT to bring? Or are you of the opinion that any monkey can be trained to open doors for you and point out the kitchen and bedrooms? Allow me break down for you in easily palatable bullet points some aspects of the showing that we feel shouldn't be missed or misunderstood: The Purpose of a Showing Compare one home to another Identify your lifestyle priorities & deal-breakers Learn to work together through collaborative communication Find the right property Make an offer Your main focus should remain fixed on the goal of the showing—to find the right property for you that fits and supports your intended lifestyle. Staying focused can not only expedite your search journey, but also help you maintain clarity as you consider one of the largest purchases you'll likely ever make personally. Behavior in a Home It's imperative now, perhaps more than ever, to refrain from touching everything in someone else's home. Not only should we be a bit more mindful of germs these days, we also don't want any liability trouble for being an unruly guest in someone's home. While many homes you'll see are vacant, many are still occupied by the homeowner or tenants. When they step out, they do that to allow you a chance to investigate for yourself what it would be like to live in that home. Their belongings often add depth, warmth and character to a space, but keep in mind that you're there to evaluate the spaces that will remain after all of the personal property has been removed. Opening doors and drawers is a reasonable thing to do if they're part of an item, such as a cupboard, that will remain behind after a sale. Dresser drawers, for instance, should be left alone as they are personal property and not typically part of a real estate sale. For more on what's considered an inclusion or exclusion in a real estate sale follow this link. Remember this is someone else’s home and they’ve allowed us to come see it. Refrain from perusing or touching seller’s personal items Be respectful of the seller’s home & belongings, culture & lifestyle choices within their own home Mind basic manners Children should remain in your sight at all times All members in your parties should remain in a group Expect that you are being listened to. Refrain from sharing personal information, speaking ill of the sellers or their home, or sharing negotiation strategies. Many sellers now use cameras and listening devices for security and to obtain information for negotiating to their advantage Discuss negotiations and offer details outside of the home or after we’ve left the premises You may feel like you've got a good idea of what to bring with you to a showing. For the most part, do what's intuitive. It might make sense to you to bring something to take notes on—there's usually one per couple who's geared this way. But, have you considered how difficult it can be to move freely in and out of the homes you're seeing with your agent without the right shoes? Seems simple, but that's a tip that's often overlooked. There are several other things I could list here, but these are the most important: What to Bring Wear shoes easy to slip on and off, especially in inclement weather Wear comfortable clothing Something to take notes (notebook, tablet) Water & snacks to keep you going between showings Tape measure—because there's always something you want to measure Folder to keep brochures, info packets gathered & tidy Notes you've already compiled about particular properties Map & directions, in case your phone doesn't work in the area Hard hat if you're exploring new home construction, sun hat if you're exploring acreage Lastly, while the dreaded COVID seems to be behind us, there are etiquette and protocols that have been adopted following the recent pandemic. While most agents no longer require showing parties to wear PPE, it just makes sense to be sensitive about your health when entering someone else's home. If you're sick, stay home. And, why not use hand sanitizer after each showing? That's rhetorical. You should. You definitely should. It also no longer makes sense to bring anyone who isn't a decision maker along with you to a showing unless you have your little ones who need to be under your care. Besides, the old addage of "too many cooks in the kitchen" applies. Having mom, dad, uncles or aunts there offering well-intended advice, can often confuse you and lead you to second guess your own instincts. If you're the one who's saved and scrimped, and eaten ramen when you could've had steak, just to save extra $, don't let someone else make your homebuying decisions for you. You deserve to do it yourself! As always, trust your agent to guide you through the process. Here at the Altitude Group, our experiences have led to more refined systems and processes to care for you along the way. Give us a call and let us elevate your next homebuying journey.

Read MoreOur Top 10 Tips for First-Time Homebuyers

As a seasoned real estate agent, I would love to offer 10 of my top tips for you, as first-time homebuyers. The only problem is there are far more than 10! This list should get you started–take a look. Determine Your Budget: Before you start looking for homes, establish a clear understanding of how much you can afford. This includes not only the purchase price but also additional costs like closing costs, property taxes, insurance, and potential renovations. Get Pre-Approved for a Mortgage: Getting pre-approved for a mortgage gives you a solid idea of how much a lender is willing to lend you. This helps you narrow down your home search to properties within your budget and makes your offers more credible. Identify Your Needs and Wants: Make a list of your must-haves (e.g., number of bedrooms, location, yard size) and nice-to-haves (e.g., updated kitchen, swimming pool). This will help you prioritize your search and make decisions more efficiently. Research Neighborhoods: Research the neighborhoods you're interested in. Consider factors like proximity to work, schools, public transportation, amenities, safety, and future development plans. Work with a Qualified Real Estate Agent: A skilled real estate agent can provide invaluable guidance, access to listings, and negotiation expertise. They'll advocate for your best interests and simplify the buying process. Attend Open Houses and Showings: Attend open houses and schedule showings to get a sense of different properties, their layouts, and conditions. Take notes and pictures to help you remember each home. Be Realistic About Renovations: If you're considering fixer-uppers, be realistic about your renovation skills, timeline, and budget. Renovations can be costly and time-consuming, so factor these into your decision-making. Inspect Thoroughly: Once you've found a potential home, invest in a professional home inspection. This can uncover any hidden issues and save you from costly surprises down the road. Consider Resale Value: Even if you're planning to stay long-term, it's wise to consider a property's potential resale value. Opt for features and upgrades that are likely to appeal to future buyers. Negotiate Wisely: Work closely with your real estate agent to craft a competitive but reasonable offer. They can help you negotiate with the seller to secure the best deal possible. Review the Purchase Agreement: Carefully review the purchase agreement with legal counsel if needed. Ensure you understand all terms, conditions, and contingencies before signing. Factor in Additional Costs: Remember that homeownership comes with ongoing costs beyond the mortgage, including maintenance, utilities, and potential homeowners association (HOA) fees. Don't Rush: Buying a home is a significant decision. Take your time to explore your options and don't feel pressured to make an offer quickly. Take advice carefully: It is very common for people to give you advice on the ins and outs of a real estate transaction. This advice may be accurate and useful, or it may be related to an unusual situation or standard of practice in another area. If you have concerns about anything, please do not hesitate to rely on your agent’s expertise. While family and friends may mean well, their experience buying and selling homes likely pales in comparison with what your agent knows and has experienced professionally. Visit the Property at Different Times: Visit the property during different times of the day and week to gauge noise levels, traffic, and overall ambiance. Trust Your Instincts: While it's important to be analytical, also trust your gut feeling about a property. If something doesn't feel right, it's worth investigating further or considering other options. Remember, the homebuying journey can be exciting but also overwhelming. Surrounding yourself with knowledgeable professionals and taking each step thoughtfully ensures you find a home that fits your needs and aspirations. If you’re looking for a team of seasoned agents, like we have here at The Altitude Group, please reach out and we would love to walk you through the homebuying process together.

Read More-

It seems that if there's one thing that any home seller wants during a home sale process is to be able to be in control of every aspect along the way. The outcome matters. So, the good news is there are actually three, but only three things that we can actually control in real estate. And that is: what your home looks like when we put it on the market, what price we will put it on the market for, and what you will take as a price when you receive a contract. At the end of the day, there’s only one fundamental truth in real estate and that is that the market is going to dictate what your home is worth. Not me, not you, not your neighbor, not your dad, and certainly not a Zestimate, so what I advise my clients is: let’s shift our focus to strategy win the three things that we know to be certain…to strategy and how we’re going to position your home to win, when we put it on the market. At the Altitude Group, your outcome matters to us too. Let us help guide you through your home sale. Reach out and let's start the conversation.

Read More Aging with Grace: Unveiling the Benefits of Community Living for Seniors

The Many Benefits of Aging in a Community There’s comfort in being around people who share common interests, goals, and challenges. That comfort in a community doesn’t wane with age – it actually deepens. Whether it’s proudly talking about grandchildren or lamenting the fact that our eyes aren’t as good as they used to be, it helps to be around people who not only understand what we’re saying but actually feel the same joys and concerns as well. That’s why many boomers are deciding to move into an active adult community. In the latest 55places National Housing Survey, they were described by one out of three seniors as an “outgoing, social community of likeminded people.” Bill Ness, Chief Executive Officer and Founder of 55places.com, explains: “Baby boomers are now reaching the age when moving to an active adult community is the ideal opportunity for them…Many boomers now want to downsize, experience a maintenance-free lifestyle, and pursue more social opportunities. It’s exciting that there are so many choices for baby boomers.” There’s still a desire, however, among many seniors to “age-in-place.” According to the Senior Resource Guide, aging-in-place means: “…that you will be remaining in your own home for the later years of your life; not moving into a smaller home, assisted living, or a retirement community etcetera.” The challenge is, many seniors live in suburban or rural areas, and that often necessitates driving significant distances to see friends or attend other social engagements. A recent report from the Joint Center for Housing Studies of Harvard University (JCHS) titled Housing America’s Older Adults addressed this exact concern: “The growing concentration of older households in outlying communities presents major challenges for residents and service providers alike. Single-family homes make up most of the housing stock in low-density areas, and residents typically need to be able to drive to do errands, see doctors, and socialize.” The Kiplinger report also chimed in on this subject: “While most seniors say they want to age in place, a much smaller percentage of them actually manage to accomplish it, studies show. Transportation is often a problem; when you can no longer drive, you can’t get to medical appointments or to other outings.” Driving may not be a challenge right now, but think about what it may be like to drive 10, 20, or 30 years down the road. There are also health challenges brought on by a possible lack of socialization when living at home versus a community of seniors. Sarah J. Stevenson is an author who writes about seniors. In a recent blog post for A Place for Mom, she explains: “Social contacts tend to decrease as we age for reasons such as retirement, the death of friends and family, or lack of mobility.” Thankfully, research from the same article suggests if you’re spending time with others in a community, thus reducing the impact of loneliness and isolation, there’s less of a risk of developing high blood pressure, obesity, heart disease, a weakened immune system, depression, anxiety, cognitive decline, Alzheimer’s disease, and early death. Though the familiarity of our current home may bring a feeling of warmth, comfort, and convenience, it’s important to understand that staying there may mean missing out on crucial socialization opportunities. Living with adult children, joining a retirement community, or moving to an assisted living facility can help us continue to be with people we enjoy every day. Bottom Line “Aging-in-place” definitely has its advantages, but it could mean getting “stuck-in-place” too. There are many health benefits derived from socialization with a community of people that shares common interests. It’s important to take the need for human interaction into consideration when making a decision about where to spend the later years in life.

Read MoreWhy We Recommend Our List of Lenders

Finding a mortgage lender is not difficult. Finding a decent one isn't terribly hard either, but are they great? I can tell you from experience, you do not want to settle for any lender who isn't great at what they do. Financing is often responsible for the lion's share of headaches I've endured in real estate over the years. Your Options We understand and respect that you have options. There are the in-house lenders where you already do your banking, there are ones you’ve worked with in the past, online lenders, and the ones you hear about every time you turn on the radio. We, too, have our lenders that we have relationships with. We have long relationships with our lenders. We’ve developed these relationships over the past decade plus, but rest assured, there’s nothing in it for us other than knowing you’re in good hands. As realtors, our job is to see to it that we have your best interests are always in mind. So, when we recommend our lender, it’s because we know what they’re capable of. It's becuase we know that you won't be made to suffer from professional ineptitude and lack of accumen. The Lynchpin of a Financed Real Estate Transaction In our opinion, lending is the lynchpin of the real estate process. By definition, a lynchpin is the fastener that keeps a wheel from sliding off an axle. With bad, or even mediocre, lenders involved, a real estate transaction can make the wheels come off really quickly. But with the right lender, one with whom we’ve worked before and one from whom we know what to expect, your already stressful big decision to buy a home is made simpler, easier, and less stressful--and that’s the goal. Allow us to suggest a few of the best loan officers we’ve come across and some of the reasons we think you should consider working with them.

Read More-

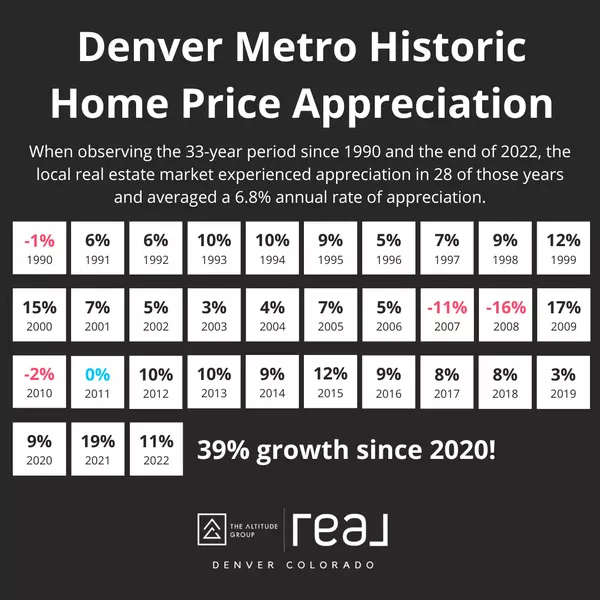

If I told you about an investment that, over the past 50 years, has averaged nearly 7% (6.8%) gains year over year, you would say what? Yet, so many people I talk with right now are feeling confused about where the real estate market is headed in 2023 given the grim news they heard over the last half of 2022. It seemed that the news media on TV and online sewed seeds of confusion and uncertainty about the voracity and viability of investing in real estate into the hearts of homeowners and prospective homebuyers. But let's take a step back from scrolling our devices and look at the actual data over the last 10, 30, even 50 years of actual data. I think you'll find--with clarity and certainty, that investing in real estate has historically been a winning proposition.

Read More Helping Your Senior Loved One Move Out of Their Forever Home

Moving is never an easy task, especially for seniors who have been living in their home for decades. Leaving the familiar surroundings, memories, and routines can be a challenging experience for anyone, but for seniors, it can be particularly stressful. Whether they are downsizing or moving to an assisted living facility, helping seniors transition from their long-time home can require careful planning and execution. Here are some tips to help seniors move out of the house they've been in forever: Start early and plan ahead: Moving can take a lot of time and effort, and for seniors, it can be even more difficult. Starting the process early and planning ahead can help alleviate some of the stress and ensure a smoother transition. Create a timeline and checklist of everything that needs to be done, including packing, sorting through belongings, and hiring movers. Get organized: Decluttering and downsizing are essential when it comes to moving. Encourage seniors to go through their belongings and decide what they want to keep, sell, donate, or discard. Downsizing can be an emotional process, so it's important to be patient and supportive. Enlist help: Moving can be physically demanding, and seniors may need extra help with tasks like packing, lifting, and moving. Consider hiring professional movers or enlisting the help of family and friends. This can also provide emotional support and make the process less daunting. Consider the new living arrangements: Whether it's a smaller home, apartment, or assisted living facility, make sure to take into account the new living arrangements when packing and downsizing. Consider the size of the new space and the amenities provided, and make sure to bring only what is necessary and meaningful. Create a comfortable new space: Moving can be overwhelming, so it's essential to make the new space as comfortable and familiar as possible. Encourage seniors to bring cherished items like photographs, artwork, and furniture to make the new space feel like home. Take care of legal and financial matters: Moving can also involve a lot of legal and financial paperwork, such as updating wills, transferring utilities, and closing bank accounts. Make sure to take care of these matters in advance to avoid any last-minute stress. Provide emotional support: Moving can be an emotional experience, particularly for seniors who have lived in their home for a long time. Provide emotional support by listening to their concerns, acknowledging their feelings, and being patient and understanding throughout the process. Bottom Line Helping seniors move out of the house they've been in forever requires careful planning, organization, and emotional support. By following these tips, you can help make the transition as smooth and stress-free as possible. Remember, moving can be a challenging experience, but with the right support, seniors can make the transition to their new home with confidence and comfort.

Read MoreFrom Savings to Shopping: The First Step in Buying Your Dream Home

Looking for the penultimate advice for to how to buy your first home or even your dream home? Start with your savings Your First Step Toward Buying a Home When preparing to buy a home, the first thing many homebuyers do is look at the real estate listings on homeshopping websites, on social media sites or in magazines. Some potential buyers read how-to articles like this one. The next thing you should do - before you call on an ad, before you talk to a REALTOR®, before you shop for interest rates - is look at your savings. Why? Because determining how much money you have available for down payment and closing costs affects almost every aspect of buying a home - including how you write your purchase offer, the loan programs you qualify for, and shopping for interest rates. Mortgage Programs If you only have enough available for a minimum down payment, your choices of loan program will be limited to only a few types of mortgages. If someone is giving you a gift for all or part of the down payment, your options are also limited. If you have enough for the down payment, but need the lender or seller to cover all or part of your closing costs, this further limits your options. If you borrow all or a portion of the down payment from your 401K or retirement plan, different loan programs have different rules on how you qualify. Of course, if you have enough for a large down payment, then you have lots of choices. Your loan choices include such varied programs as conventional fixed rate loans, adjustable rate mortgages, buydowns, VA, FHA, graduated payment mortgages and all the varieties of each. Shopping for Rates A very important reason you need to have at least some idea of your down payment is for shopping for interest rates. Some loan programs charge a slightly higher interest rate for minimal down payments. Plus, the interest rates for different loan programs are not the same. For example, conventional, VA, and FHA all offer fixed rate loans. However, the rates vary from one program to another. If you shop lenders by phone, the loan officer will be able to tell you which programs fit and quote your rates accordingly. However, if you are shopping on the Internet, you have to develop some idea of your loan program on your own. Writing Your Offer Gosh, I could explore this idea for ever. Every offer is different, and there is no one-size-fits-all advice for all offers. But what does your down payment have to do with your offer? Well, reason you need to have decided on your down payment is because it affects how you write your offer to purchase a home. Not only are you required to put your down payment information in the offer, but also different loan programs have different rules that also affect how you write your offer. This is especially important when dealing with FHA and VA loans. If you are asking the seller to pay all or part of your closing costs, you have to be certain your loan program allows what you are asking. For smaller down payments, lenders allow the seller to pay less closing costs than for larger down payments. Some loan programs will allow a seller to pay certain types of costs, but not others. Finally, your down payment also affects your ability to qualify for a loan. When you make a small down payment, lenders are fairly strict about having you conform to their underwriting guidelines. For larger down payments, they will tend to make allowances or exceptions to the rules. Bottom Line As you can see, the down payment affects every choice you make when you buy a home. Although you should look at ads, familiarize yourself with neighborhoods, learn about prices, and read as much as you can - when you get ready to take action - the first thing you should do is figure out how much money you have available for the purchase.

Read More

Categories

- All Blogs 60

- advice 18

- broomfield colorado 1

- buying land 1

- client experience 8

- colorado 11

- commerce city colorado 2

- denver metro area 12

- ELEVATE newsletter 14

- FAQs 1

- firestone colorado 1

- first-time homebuyers 8

- foothills properties 1

- for sellers 8

- home improvements 1

- home valuation 1

- homebuyers 21

- homebuying in 2024 11

- inflation 4

- interior design & decor 1

- investing/investors 3

- land surveys 2

- local news 11

- market updates 1

- matt thomas 3

- monthly housing updates 7

- mortgage interest rates 12

- mortgage lending 8

- mountain properties 1

- moving 2

- national news 9

- negotiations 2

- open houses 1

- opinion 2

- press release 3

- property management 2

- property taxes 2

- radon 1

- ReaL Broker 2

- relocating 4

- remote homebuying 1

- rentals 1

- renting 1

- senior homeowners 2

- showings 3

- the altitude group 4

- thornton colorado 3

- videos 4

- vocabulary 4

Recent Posts